Does your policy effective date impact your renewal increase?

February 27, 2024

Mike BartonDoes your January 1 renewal cost you more money?

The pros and cons of a January 1 medical insurance policy effective date

Every business has a critical unit of measurement impacting its financials. For hospitals, it is “patient days.” Lawyers recognize “hours billed.” Golf courses value “rounds played.” For health insurers, it is “member months.”

So, what is a member month, and why is it so important to health insurers? A member month measures the number of humans insured and the length of the exposure (usually during the calendar year or policy year). The more member months = greater financial impact to insurers balance sheet.

Here is how it works. A group with 65 employees and 35 enrolled dependents has 100 members. If the policy they enroll in is a January 1 effective date, the member months are calculated as 100 members x 12 months = 1,200 member months. Correspondingly, if that same group has a July 1 effective date, the value to the insurer for the calendar financial period is only 600 member months (100 members x 6 months). The balance accrues in the following year.

As a consequence of this paradigm, renewals later in the year have far less economic impact on the insurer's bottom line for calendar financials. Now comes the important part. 40% of buyers renew their policies on January 1st. Adding in the disproportionate value of early-year member months, roughly 70% of the insurer’s annual revenue is set, with the majority coming from January 1 renewals. Put another way, January 1 is the most important renewal month for a health plan business.

Now, if you were the CEO of a big health insurer, which revenue month would you absolutely, positively want to hit your revenue target? Health insurance carrier financials are driven by a second KPI, rate per member per month (pmpm). Rate pmpm x member months = revenue.

Let’s go back to our original exercise for ABC Co with 100 members and a January 1 effective date. 1200 member months x $750 pmpm rate = $900,000 in the calendar year. That same group renewing on July 1 is worth $450,000 in the calendar year. See the point? From an insurer’s perspective, January 1 largely determines the financial success for the year.

Think of it this way. A $2B insurer will earn $1.2B of its annual revenue on January 1. From an underwriting perspective, this is the month basic economic instincts dictate wild conservatism. If an insurer misses its rate pmpm target for January 1, given the disproportionate weight of member months, they simply cannot make up for the miss throughout the balance of the year.

Put another way, January 1 renewals have the least probability of receiving rate relief, given their value in the annual financial statement. If you are looking for a renewal “deal,” January is the wrong time to seek it…

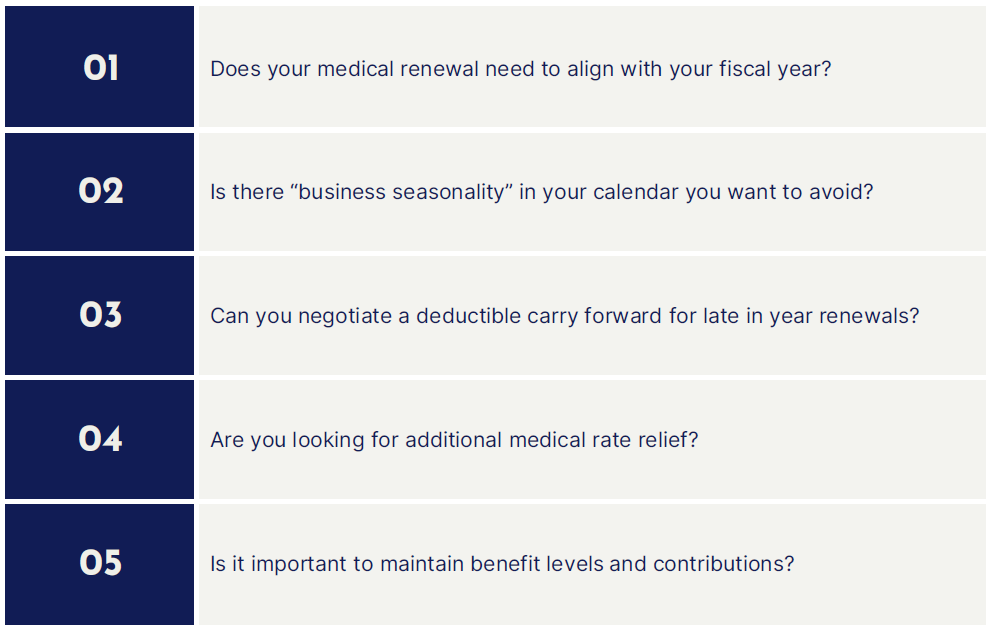

The key “benefit reason” plans enjoy a January 1 effective date is the opportunity to align “calendar year” benefits for DED and OOP maximum reasons. These are important considerations not to be dismissed.

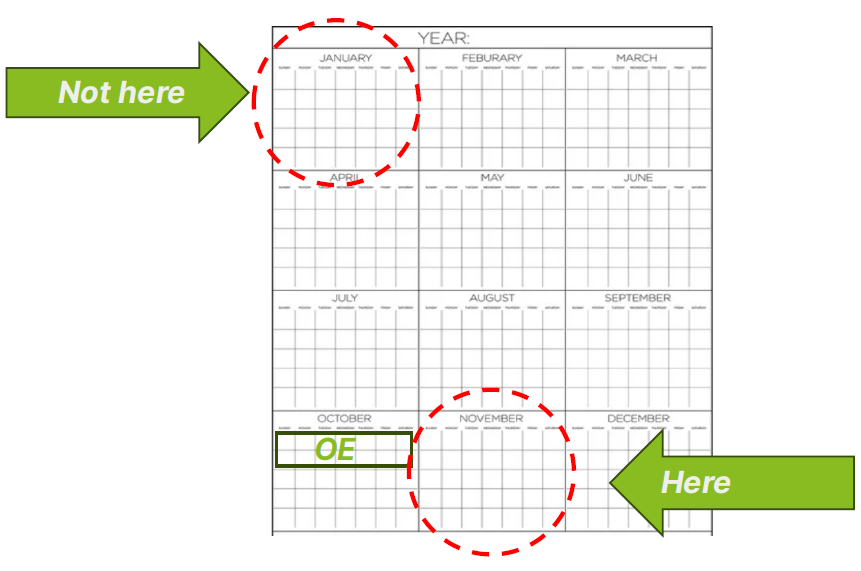

However, there are other important factors that make January renewals complicated.

- Competing for insurer/broker resources during OE season.

- Conducting OE during the holidays

- Hoping mail delivery of ID cards isn’t impacted by either weather or holiday season shipping

- Getting the attention of employees to communicate important benefits during the holidays

- Renewals/OE could be a distraction from “closing the business year”

So, when is the best time to buy medical insurance? The right answer is what works best for your company based on your unique interests and business considerations (e.g., fiscal year).

However, if you ask the question, when can I get the best “deal” on my medical renewal? Then, the answer is a little different. Insurers act like most businesses. There are times of the year when sales activity dips and “promotions” spring to life.

Insurers need to satisfy two important stakeholders: 1) providers who rely on them for “member” traffic and 2) investors who want to see growth revenue and earnings. By the time August rolls around, insurers know if they are on track to hit plan (July is their second biggest month). If an insurer is behind in August, furious meetings ensue, and discussions around “relaxing” underwriting rigor become top agenda items.

That said, there are usually one or two health insurers rolling out promotions beginning with September renewals and continue for the balance of the year (or until sales gaps are met).

So, what is the best month to buy coverage? Well – all things considered – you might want to consider November as your new effective date. Why?

First, you can usually negotiate a “deductible carry forward” provision to align benefit levels to the calendar year. Second, the push for resources sucked up by the January 1 renewals has not yet commenced. And you don’t have to compete with the holidays since your OE will likely be completed by the middle of October.

Again, the right answer to the appropriate renewal date is “whatever works best for your business.” Short or long policies can be negotiated by your broker to get you to a November renewal.

But if you are looking for a renewal deal, you can do a lot worse than a November effective date…

5-point checklist

This update is not intended to be exhaustive, nor should any discussion or opinion be construed as legal advice. Readers should contact legal counsel for legal advice. All rights reserved.