Program Modernization

March 15, 2024

Mike BartonWhat if health insurance actually made people healthier?

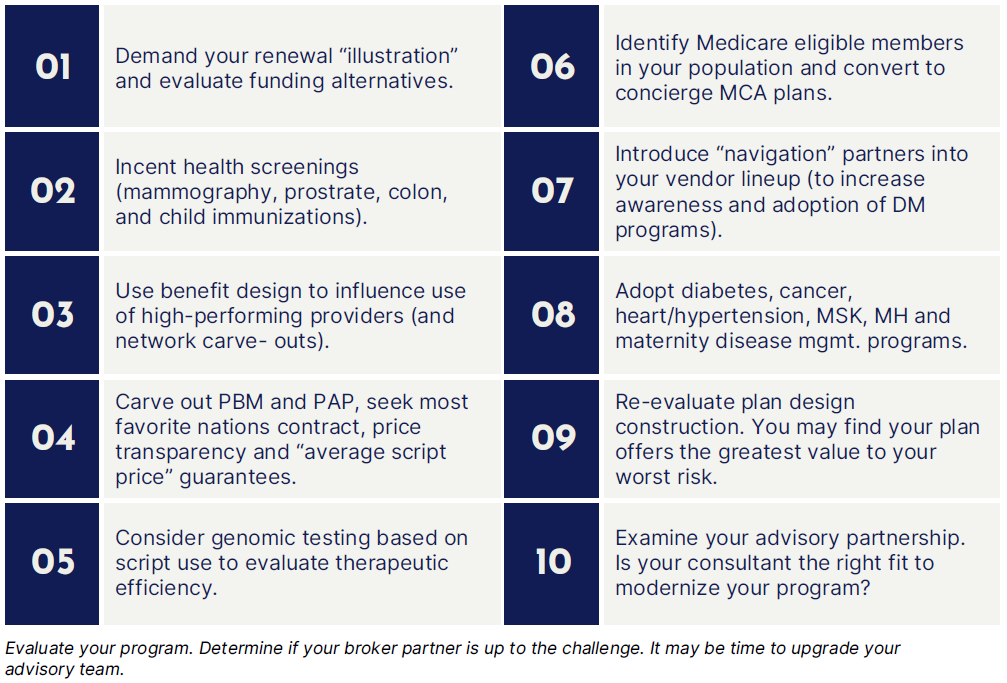

10 tips to take back control of your medical program

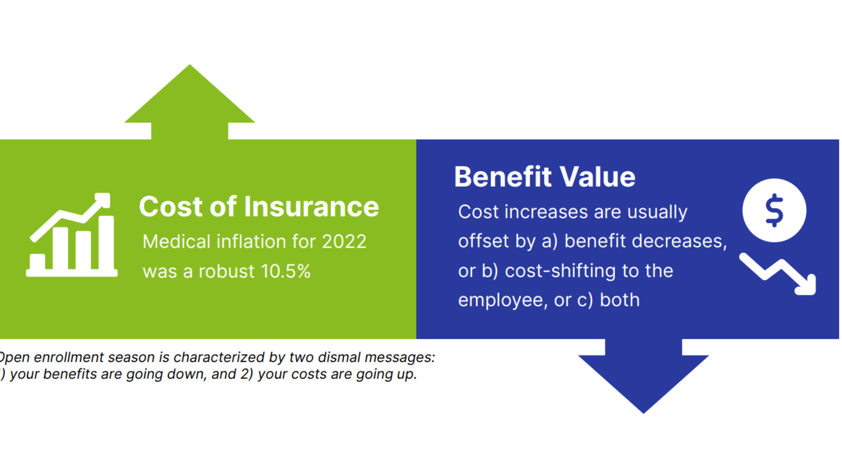

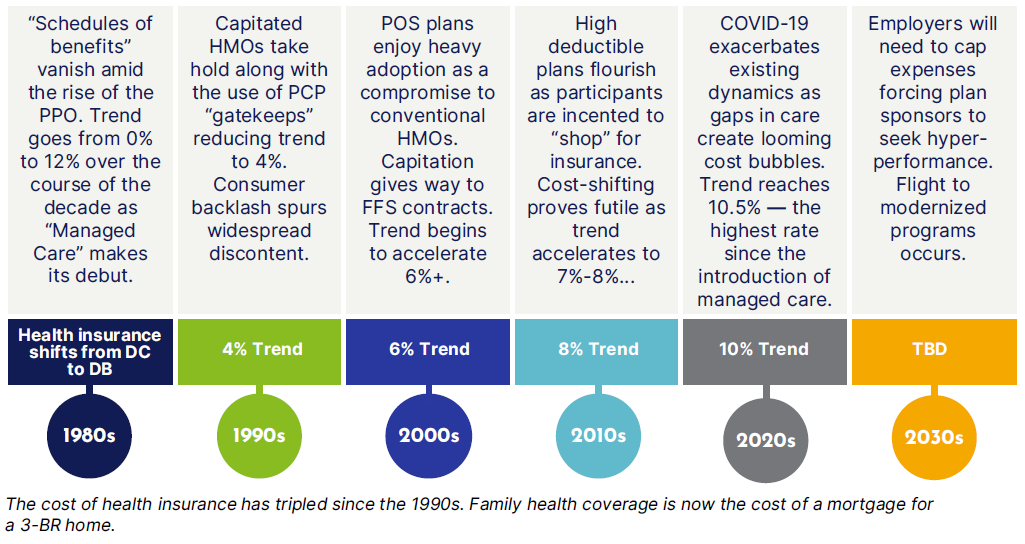

Health insurance is in a perpetual state of devolution. Our medical plans seemingly defy the physical laws of natural selection where only the fittest survive and evolve. Despite numerous course corrections and alleged innovations, the rate of inflation has escalated every decade since the mid-1990s.

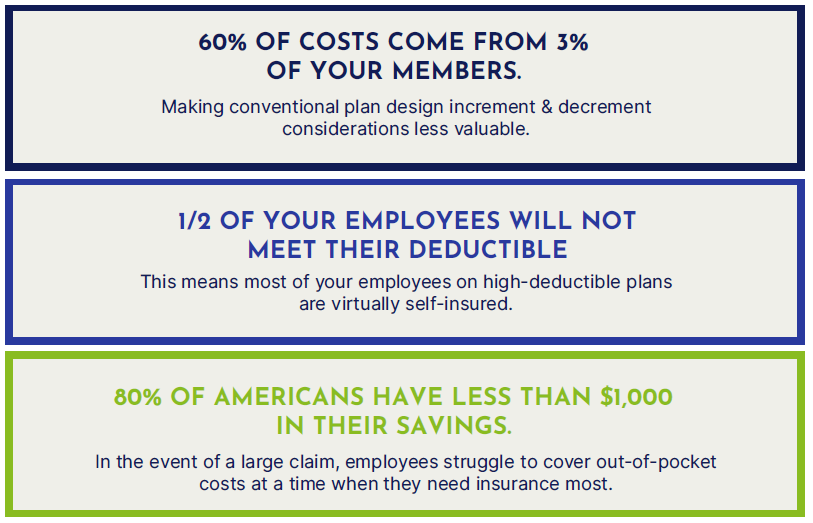

Health care reform failed to produce cost savings and even added expense as insurers spread the cost of uninsured across their fully insured populations. High deductible plans —held as the salvation of health insurance —succeeded only in shifting expense back to the employee in the name of making us better “shoppers” of health care.

A historical view of medical inflation

Despite innumerable course corrections there has been little success in abating the pace of cost increases

What is the path forward for employers?

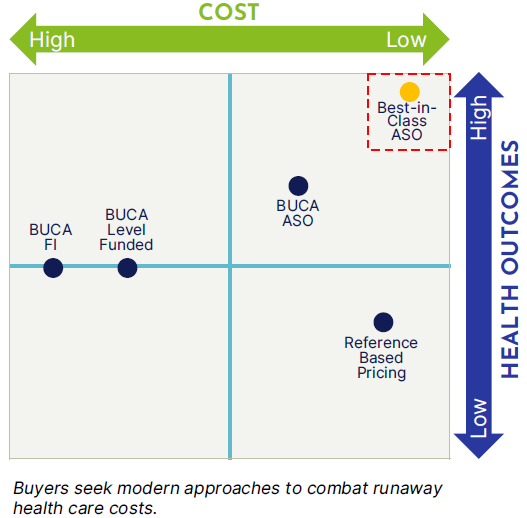

Employers will seek to modernize medical programs to reduce waste and carrier profit and improve health outcomes. The tightening economy will hasten the flight towards program modernization as employers seek to reduce balance sheet burden driven by escalating health care expense.

In most instances benefits represent a top 5 employer expense at a net cost of roughly $10,000 per employee per year. With this cost trending in double digits and more care-gaps created by COVID-19 underutilization on the way, cautious employers are looking for solutions.

To make matters worse, new specialty drugs in stage-3 clinical trials will force employers to make tough decisions as a slew of “$1,000,000” miracle cure drugs hit the market in mid to late 2023. Rx expense is projected to be the biggest component of health care cost by 2025.

Employers will start with an honest assessment of their benefit program’s current state. This is the “you are here” moment as business operators map out a plan to pursue best-in-class approaches to program design and funding.

Two thirds of employers with 100 –500 employees are fully insured. There are 500,000 companies in America who fit this profile. The buying decision was historically a trade: slightly higher cost in exchange for premium certainty.

That was economical when the cost per employee per year was $3,000 and trending at CPI. Today that same buying decision offers only a guarantee to lock-in the highest cost of insurance with a highly predictable 8%-10% increase at renewal. The economics have changed and so should our strategies.

Best-in-Class program design

There are intractable factors beyond your control as you look to combat rising health care costs. The American health care system is characterized by:

- Aging population

- Advancement in pharmacology

- New technology

- Lack of real tort reform

- Entrenched political lobbies

- Carrier oligopoly

- Rx patent law abuse

There is little available to you to affect these pieces of the cost equation. However, employers can make a meaningful impact in areas within your control. The average medical cost per employee per year is $10,000. The reality is there is a tremendous amount of waste in fully insured pricing. Your job is to identify and eliminate the excess.

So —where do you start? Look at things you can control. In most instances you have the ability to shave off ~ $1,000 per employee per year in cost by simple being a better purchaser of insurance.

Don’t overlook the obvious or assume your program has no room for improvement. Ask yourself tough questions:

- When was the last time I benchmarked my program?

- Do I use the most efficient form of funding?

- Does my contribution strategy attract the right talent (and risk)?

- Do I encourage the use of high-performing physicians?

- Am I doing everything I can to identify and eliminate care-gaps?

Modernizing your program will likely include re-evaluating funding, carving in programs for chronic disease states, and deploying care navigation platforms designed to maximize transparency and decision making in the health care delivery process.

First, don’t assume your medical carrier “has your back.” Health insurers operate for one purpose: to maximize underwriting gain. What used to be a straightforward renewal justification, has become a charade designed to obfuscate the real cost of coverage.

The only assumption you can make about your renewal, is that the “illustration” (if you even get one), bears little resemblance to the truth —and may only be directionally accurate. View your renewal with a healthy dose of skepticism.

Given this, and the tripling of costs since the ’90s, most employers with greater than 100 participants may be better off self-funding (or at least performing an honest feasibility study with forecast with confidence bands over a 5-year period).

The 10 tips below represent a blueprint to minimize fixed expense while mitigating claims costs through improved health outcomes. The payoffs are reduced price-points and trend mitigation over the long-term. You may even succeed in using health insurance to make employees healthier…

This update is not intended to be exhaustive, nor should any discussion or opinion be construed as legal advice. Readers should contact legal counsel for legal advice. All rights reserved.