Reference-Based Pricing Revealed

February 26, 2024

Mike BartonIs reference based pricing really a cost-savings panacea?

Examining the math behind the promise of cost reductions

Reference-based pricing programs (RBP) entered the scene as a low-cost alternative to conventional carrier-based programs. Conventional insurance relies on BUCA networks with contractual provider agreements paying roughly three times Medicare reimbursement. With the average medical cost per employee per year (PEPY) estimated at $14,000 and trending at 8.5%, a rational solution is warranted.

RBP proposes to replace BUCA reimbursement schedules with no provider contracts, instead offering payment at 140% of Medicare (about ½ of conventional BUCA payment). Simply put, in the absence of a contract, the third-party administrator (TPA) simply issues a check for the reduced amount and the patient assumes responsibility for any balance billing. RBP claim re-pricers insist that in 95% of Incidences, the provider accepts the reduced amount as payment in full.

This is where the rubber meets the road. What happens when the provider “doesn’t” accept RBP reimbursement as payment in full? Here, the member is held responsible between what is paid (140% of Medicare) and billed charges (which could be 600% or more of Medicare). RBP offers several models to mitigate the natural tension that exists when reimbursement does not match billed amounts:

- Offer underlying rented networks for physician-related expenses (the vast majority of claims in this instance are paid at “contracted” amounts, and balance billing is muted). However, in these instances, there is also no RBP savings for those charges.

- Hold the patient harmless and negotiate with the provider to reduce the billed amount. In some cases where agreement is not found, the RBP TPA will utilize a law firm to issue threatening letters to force the provider’s hand and negotiate in good faith. However, these negotiated amounts also eat into the projected savings of the program, often dampening financial favorability.

- Hold the line and transfer the full risk of balance billing to the patient. Some of the horror stories attributed to RBP come from this approach, generally used in the early days of RFP before providers saw greater deployment of the program.

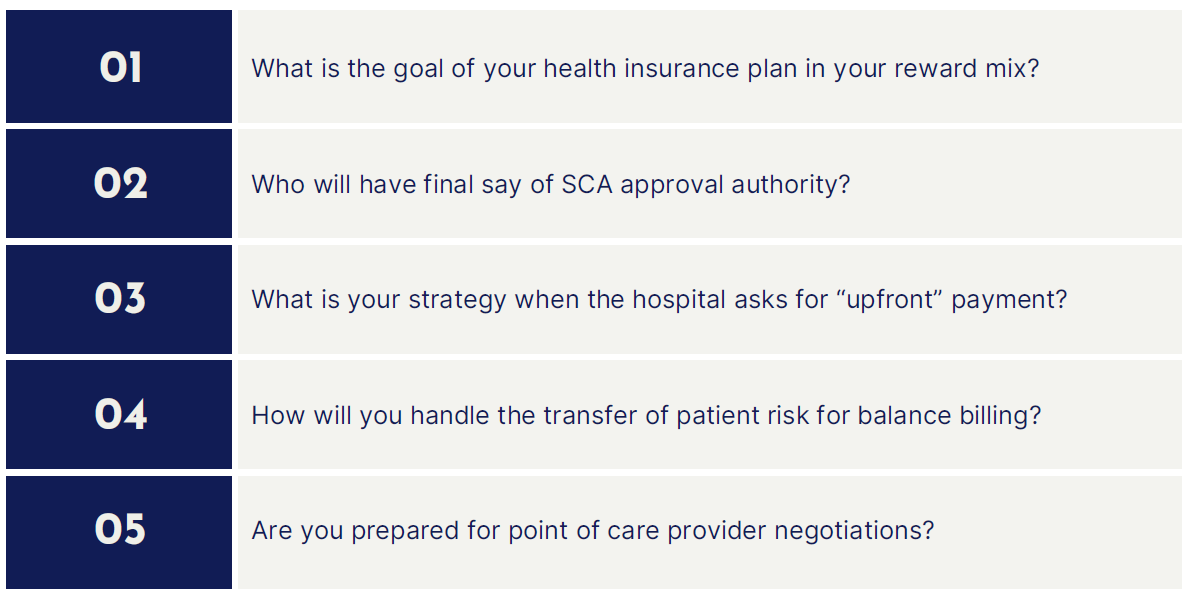

- More recently, providers will request “pay upfront” when they suspect a RBP plan is in play. Suspicions arise when there is not a recognizable BUCA logo on the ID card. This leads to point-of-care provider negotiations with a “single case agreement” (SCA) so a member can receive scheduled care. Unfortunately, these tend to happen when the patient is checking in for a procedure and the timing is urgent. At this point, providers hold all the leverage because the patient is literally in their office expecting to undergo a procedure.

- With little leverage, the RBP TPA usually settles on a “discount off billed charges” of 10%-30%. This is a far cry from the promise of 140% of Medicare (more realistically, 500% of Medicare). In these cases, a TPA debit card is used to pay the bill so the procedure can begin.

So, where does this leave us? Does the promise of claims savings outweigh the emotional toll of a process that transfers the risk of care to the patient at a time when they are also juggling compromised health? To answer that question, we need to dive in deeper into the major components of care impacted by RBP. Then, we need to strip out the costs associated with SCA’s and hold the member harmless for balance billing risk. Only then can we assess the real savings associated with RBP vs. conventional self-funded approaches using a BUCA network of providers.

This ultimately brings us back to the number (and type) of claims typically disputed by providers. The RBP’s infamous “only 5% of claims result in dispute…”.

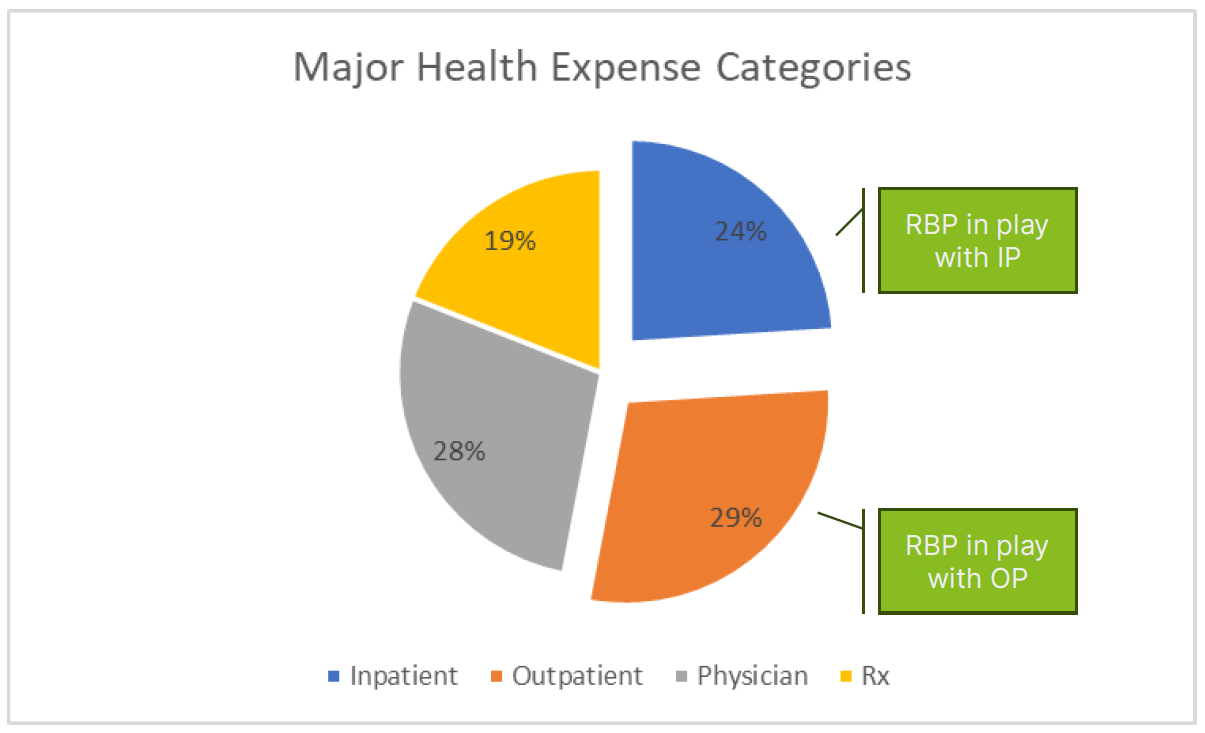

Let’s start with the major components of healthcare expense. From there, we can determine which component cost is likely impacted by RBP re-pricing reimbursement at 140% of Medicare.

At its broadest level, there are four main elements of healthcare expense:

- Inpatient facility

- Outpatient facility

- Physician

- Prescription

RBP approaches thus far do not anticipate any leveraged effect on Rx expenses. However, this may change as CMS negotiates pricing on select drugs for Medicare recipients. Similarly, most RBP models use an underlying provider network like PHCS to facilitate claims payment for high-volume, low-dollar provider expenses. The real savings opportunity exists in low frequency, high dollar facility-related costs.

If RBP largely impacts two main components of healthcare – inpatient and outpatient expense, what is that worth in terms of real financial value?

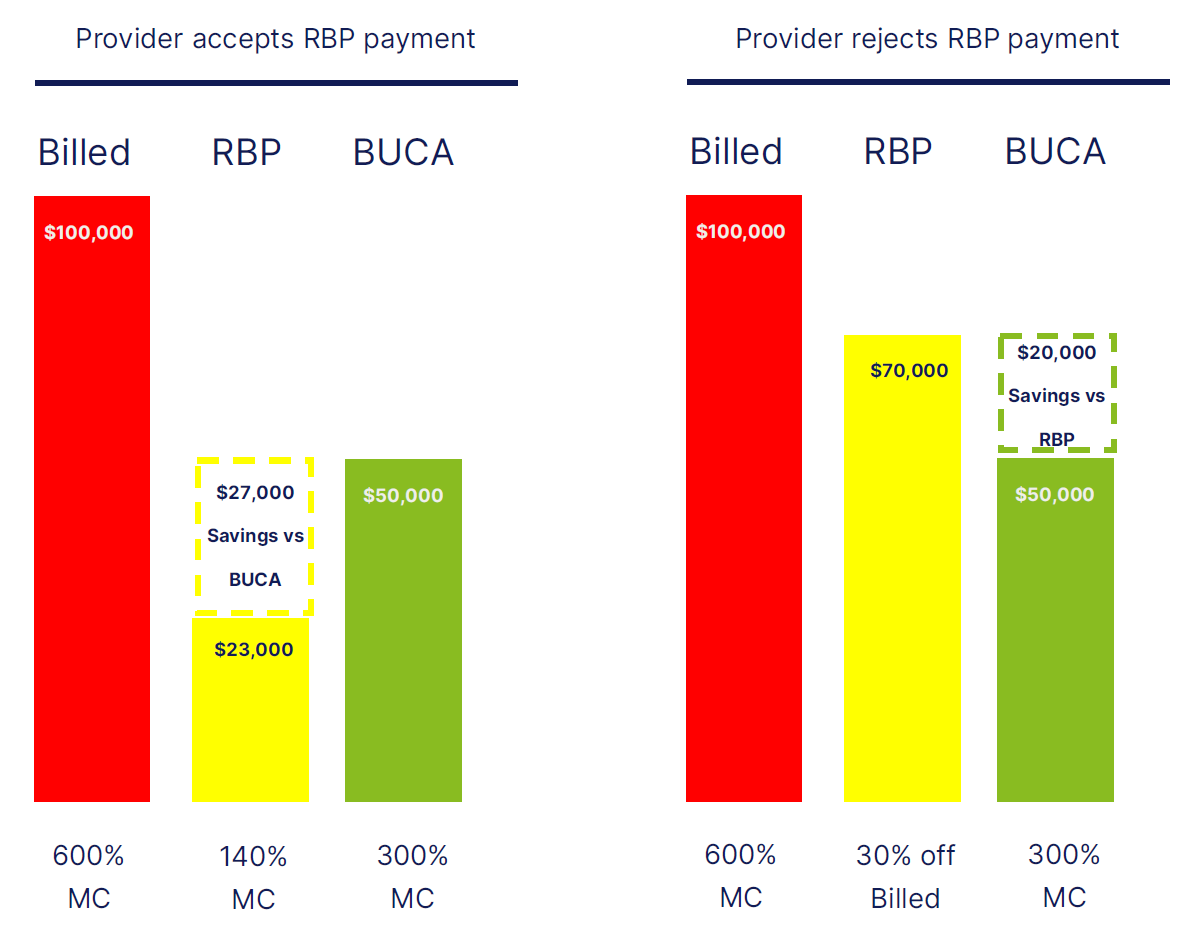

To answer that question, we need to examine two different claims scenarios:

1) Where the provider accepts RBP re-pricing as payment in full and

2) Instances where a SCA is needed to settle the claim. Once analyzed, we can answer the question of what is the net delta in cost between a conventional BUCA network and a RBP re-pricing strategy.

In our example, we will assume a $100,000 inpatient claim at the billed charge amount.

Most of us are looking for solutions to the healthcare cost quagmire. Understandably, RBP approaches gained traction vs. conventional plans, offering little promise in both unit cost and trend reductions. The value of RBP ultimately comes down to the 5% of disputed claims. Invariably, a handful of claims drive 2/3rds of your medical expense. As such, it is these needle-moving events that answer the question, “Does RBP offer meaningful savings vs. BUCA-based programs?”

Savings are negligible at best when an SCA is needed to settle a claim. In those situations, potential savings are sacrificed at the point of care. In any event, the “real” net savings are probably somewhere in the 4%-8% range. Is it worth the human toll RBP demands? Or are there less disruptive ways to recapture savings while maintaining the integrity of the program and preserving a key element of your employee value proposition?

5-point checklist

This update is not intended to be exhaustive, nor should any discussion or opinion be construed as legal advice. Readers should contact legal counsel for legal advice. All rights reserved.